Industrial Policy: The Printing Industry and an Industrial Strategy for Europe

31 March 2020

The Printing Industry and an Industrial Strategy for Europe

Intergraf, the European federation for the printing industry, represents 112,000 companies, and their 625,000 workers. The industry has a turnover of €79.50 billion, or €160 billion when printed packaging is included. A key feature of the printing industry is that it is mainly composed of small companies, with 90% of companies employing fewer than 10 staff. Although small, the companies are mighty, making up 5.5% of the manufacturing industry.

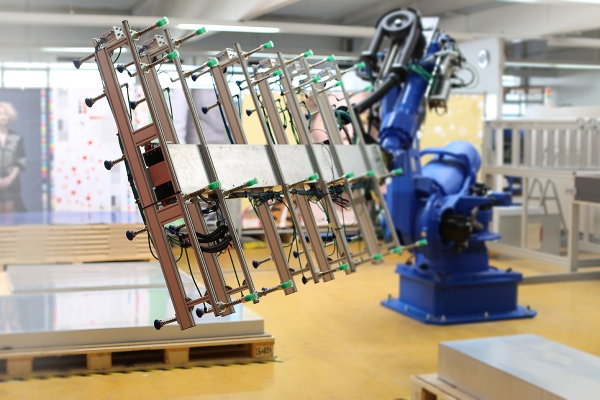

European industry as a whole is facing a time of unprecedented change. For the printing industry, Intergraf sees the drivers of change as: new technologies, innovation and business models; climate goals and environmental challenges; globalisation and global economy; societal changes: generational culture and customers changes; and structural changes. Contrary to what many people think: the industry is rapidly changing and innovating. Factories would not be able to function on a daily basis without digital tools and are home to creatives – in addition to the core of technicians who run the machines.

Intergraf is a member of Industry4Europe. The newest joint paper, signed by 149 industrial organisations ‘A long-term strategy for Europe’s industrial future: from words to action’ is fully endorsed by the printing industry. In addition, we have set out below the 4 top priorities for our industry. We conclude with Intergraf’s ‘Wish List’ for the EU’s industrial strategy.

In essence: the EU’s industrial strategy for the coming years must aim to support indispensable industries compete in global markets and keep jobs in Europe.

1. SMEs

As the vast majority of printing companies are SMEs, Intergraf calls for an industrial strategy tailored to the needs of small companies. This is because SMEs are particularly vulnerable to change. Small companies operating with only a few members of staff struggle far more than large companies to adapt. Failure to do so is to the detriment of the business and people’s jobs.

Fierce competition from abroad has led to the production of previously key sources of income for the printing industry, such as mass-produced books, to move outside of Europe. Achieving a level playing field is crucial and aligning the EU’s values with trade policy is at the heart of this. The EU needs to ensure that the high environmental, health and safety as well as social standards in Europe for the printing industry are also applicable to imported printed products. For instance, printed paper products are a major market. The EU Timber Regulation needs to be extended to ensure that imported printed products are safe from illegal logging. Currently the scope of the Regulation covers most timber products but not printed products.

SMEs are centres of great innovation, which must be fostered. Access to finance is key for companies to invest and grow. It is already an issue for printers to secure financing, and Intergraf warns of moves towards an EU sustainable financing taxonomy which risks distancing manufacturing sectors further from financing possibilities.

The EU’s industrial strategy must put SMEs at its core, with the proper support structures in place. For instance, EU-funded digital centres could impart knowledge to SMEs, thereby supporting companies to digitalise their production facilities and to implement measures to enhance the digitalisation process.

2. Skills & Recruitment

Digitalisation; an ageing workforce; image problems fuelling recruitment issues; and declining applications for training courses are some of the key challenges that the printing industry experiences and must overcome.

As well as filling traditional roles like machine operators, new roles within printing companies are emerging at a pace not seen before. As a result of the financial crisis, many companies had to restructure, and re-evaluate the products and services offered. Many printing companies now offer full communication services, including design and website management. This requires businesses to recruit new kinds of skills, be it on the creative or IT side, and means that the printing industry is competing for appropriately skilled staff with many other industries which do not suffer from an image of being outdated. Ensuring that appropriately educated graduates are attracted to the printing industry is crucial.

As well as recruitment, upskilling existing staff has also become more important. Lifelong learning is key for many printing companies to ensure that existing staff keep up with new developments. Intergraf calls on the EU to accelerate work on skills, and help the EU’s Member States to coordinate and share best practice.

3. Digital Transformation

A key driving force of the demand for new skills is digitisation. Not only do printers increasingly offer digital services in addition to the printed product, but factories and machinery are becoming ever more sophisticated and automatic. Smart factories, innovative products, such as printed electronics , fully digitised workflows, and data transfer are transforming the industry.

In the course of the digital transformation, manufacturers of machines and aggregates used for print production are beginning to establish new services for printers, including predictive maintenance, automated consumables logistics, benchmarking with comparable production systems and, based on this, consulting for process optimisation. These third parties use the data which is generated whilst the machines are in use.

On the one hand, printing companies can benefit from such services, but, on the other hand, they can become dangerously dependent on individual system manufacturers. This risks creating data monopolies due to restricted access to the generated data. This can make it impossible for printing companies to switch third-party providers and take their data with them. In the interests of a fair data economy, it is therefore necessary to demand that system manufacturers set up data interfaces with an open, uniform data format for all machine data generated during production. These companies cannot claim exclusive rights to data access.

Whilst the forthcoming EU industrial strategy must support and foster digital innovation, it is crucial that printed products are given the importance they deserve. Printed products surround us and we use them daily – often without us realising. While supporting the digital transition of the European Union and its manufacturing industry, the EU should not unfairly stigmatise printed products.

With a notable uptake of digital services, the printing industry is clearly not anti-digital. We simply argue that print has its place within the EU economy, as do digital products and services.

Print is there when one cannot use digital media or one simply does not want to use them . Maintaining the right for all citizens to access information in print is vital for effective, inclusive and democratic communication in Europe. Amid Europe’s digital transformation, Intergraf calls for equal importance to be placed on printed products, particularly for regulation which impacts communication markets and advertising. In an era of fake news and over-flowing spam inboxes, print is reliable, trustworthy, and effective. In an era of constant digital distraction and the growth of reading on a screen, we support the hundreds of scientists of reading, publishing, and literacy from Universities across Europe who have proven beyond doubt the importance of printed texts for learning (www.ereadcost.eu).

4. Sustainability & Circularity

Sustainable production and sustainable products are a clear demand from consumers. This is something which shapes the planning and conduct of European industry. A future industrial strategy must function in harmony with the European Commission’s Green Deal for Europe.

The printing industry has already undertaken ambitious voluntary initiatives to demonstrate its commitment to sustainability. For instance, paper recycling is already at 71.6%, but the industry is committed to reaching an even higher paper recycling rate and provides tools to calculate the environmental footprint of print products and processes.

Printers also work under a stringent European environmental legislative framework including tight controls on emissions of VOCs (Volatile Organic Compounds), an ambitious European waste policy and rigorous control of chemicals

It is also essential that industries producing consumer products commit to fair corporate practices. Consumers must be clearly and correctly informed about the environmental impact of products and services. Intergraf is dedicated to campaigning against green-washing – where companies seek to capitalise on the demand for sustainability by giving a false impression that their product is environmentally friendly. One example is claims that bills or official letters delivered electronically are more environmentally friendly than paper versions. Another is the launching and marketing of private ecolabels which do not comply either with the relevant life cycle for print nor relevant for the product at all. We strongly call on all EU legislators to address green-washing and ensure fair corporate behaviour and consumer protection.

Like many manufacturing industries, the eco transition of a printing company can be challenging. Solutions to Europe’s sustainability problem need to be workable and not penalise industry. Printing machines are a huge investment, in particular for small companies. New legal requirements need to take into consideration the investment cycle of printing machinery. Higher regulatory standards in Europe must not inadvertently relocate the EU’s carbon footprint outside of the EU. Printing in Europe is sustainable and is a core part of the circular economy. This should be celebrated, not denigrated. We strongly call on legislators as they work on new policies to remember that different industries and different sizes of companies will experience very different challenges. Helping European companies to transition should be key.

Wish List for Europe

- SMES: Capacity-building programmes, extra EU funding, and partnerships across companies and regions to help SMEs transform and adapt to change.

- SMES: Facilitate access to finance and ensure the sustainable finance taxonomy does not disadvantage manufacturing companies.

- SMES: Simplify administrative procedures and regulatory obligations.

- SMES: Apply the same high environmental, health and safety as well as social standards to imported printed products.

- SKILLS: A joined-up system of companies, education providers, and public officials to ensure that graduates’ skills match skills needed by the industry – now and in the future.

- SKILLS: Promotion of STEM (science, technology, engineering, mathematics) subjects and VET education as an attractive, long-term career choice.

- SKILLS: Benchmark national skills policies, with a focus on helping Member States to learn from each other.

- SKILLS: Support life-long learning tools, such as up-skilling, programming and coding skills which will be increasingly in high demand in many industrial jobs.

- SKILLS: Facilitate the adaptation of the workforce to new business models and working conditions through support for active Social Dialogue.

- DIGITAL: Ensure a fair data economy, with full transparency regarding which data is collected and used by manufacturers.

- DIGITAL: Ensure fair treatment of printed products versus their digital equivalents.

- SUSTAINABILITY: Ensure that policies do not create an unequal playing field.

- SUSTAINABILITY: Extend the scope of the EU Timber Regulation to printed products.

- SUSTAINABILITY: Take machinery investment cycles into consideration when implementing new policy requirements and have longer transitional periods following the adoption of new legislation.

- SUSTAINABILITY: Crack down on green-washing claims in order to enhance consumer protection.

{K2Splitter}